We have been hearing about Bitcoin everywhere. Will Cryptocurrency replace the currency of the Central Bank? Such questions arises in the minds of investors like us.

After research, the simple answer should be no. As the main important reason is that Bitcoin is not regulated by any sort of Regulation. So we can’t go to court in case of any problem arises. But in the near future it has a faint chance of happening.

Once you understand basics about Bitcoin, you can speculate a time as to when it can happen.

We have seen massive development in the field of technology this past decade. So we have to assume that even technology can change the banking industry very much.

Differentiation between Bitcoin and Central Bank Money

What is the difference between ‘central bank currency’ and ‘Bitcoin’?

The holder of the central bank’s authorized currency can only offer it for the exchange of goods and services. Bitcoin holders cannot offer it because it is a virtual currency that has not been authorized by a central bank. However, Bitcoin holders may be able to transfer Bitcoins for goods to another Bitcoin member’s account and even authorized central bank services and currency.

Inflation will reduce the fair value of bank currencies. Fluctuations in demand and the short-term supply of bank money on the money market have an impact on financing costs. However, the nominal value remains the same with Bitcoin, both the face value and the actual value change. We recently witnessed the Bitcoin split. It’s like a stock on the stock market. Companies sometimes split a stock into two, five, or ten, depending on market value. This increases transaction volume. As the intrinsic value of a currency decreases over time, the intrinsic value of Bitcoin increases as the demand for coins increases.

Therefore, hoarding bitcoins automatically enables a person to make a profit. In addition, the first Bitcoin holders have a big advantage over the other Bitcoin holders who came on the market later. In this sense, Bitcoin behaves like an asset whose value rises and falls, which is reflected in price volatility.

If the original producers, including miners, sell Bitcoin to the public, the money supply in the market will decrease. However, this money does not go to central banks. Instead, it depends on a few people who can act as central banks. In fact, companies are allowed to withdraw capital from the market. However, these are regulated transactions. This means that the Bitcoin system can disrupt the central bank’s monetary policy as the total value of bitcoins increases.

Bitcoin is very speculative.

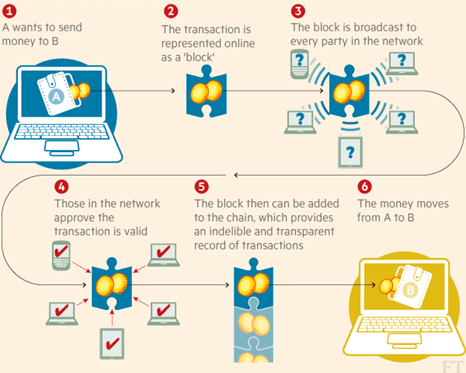

How do you buy bitcoin? Of course, someone has to sell it, sell it at a value determined by the Bitcoin market and probably by the sellers themselves. When there are more buyers than sellers, the price goes up, which means that Bitcoin behaves like a virtual product. You can then hoard them and sell them at a profit. What if the price of Bitcoin falls? Of course, you lose your money just like you lose money in the stock market. There is also another way to acquire Bitcoin through mining. Bitcoin mining reviews transactions and adds them to the ledger, which is called the Blockchain and releases new bitcoins.

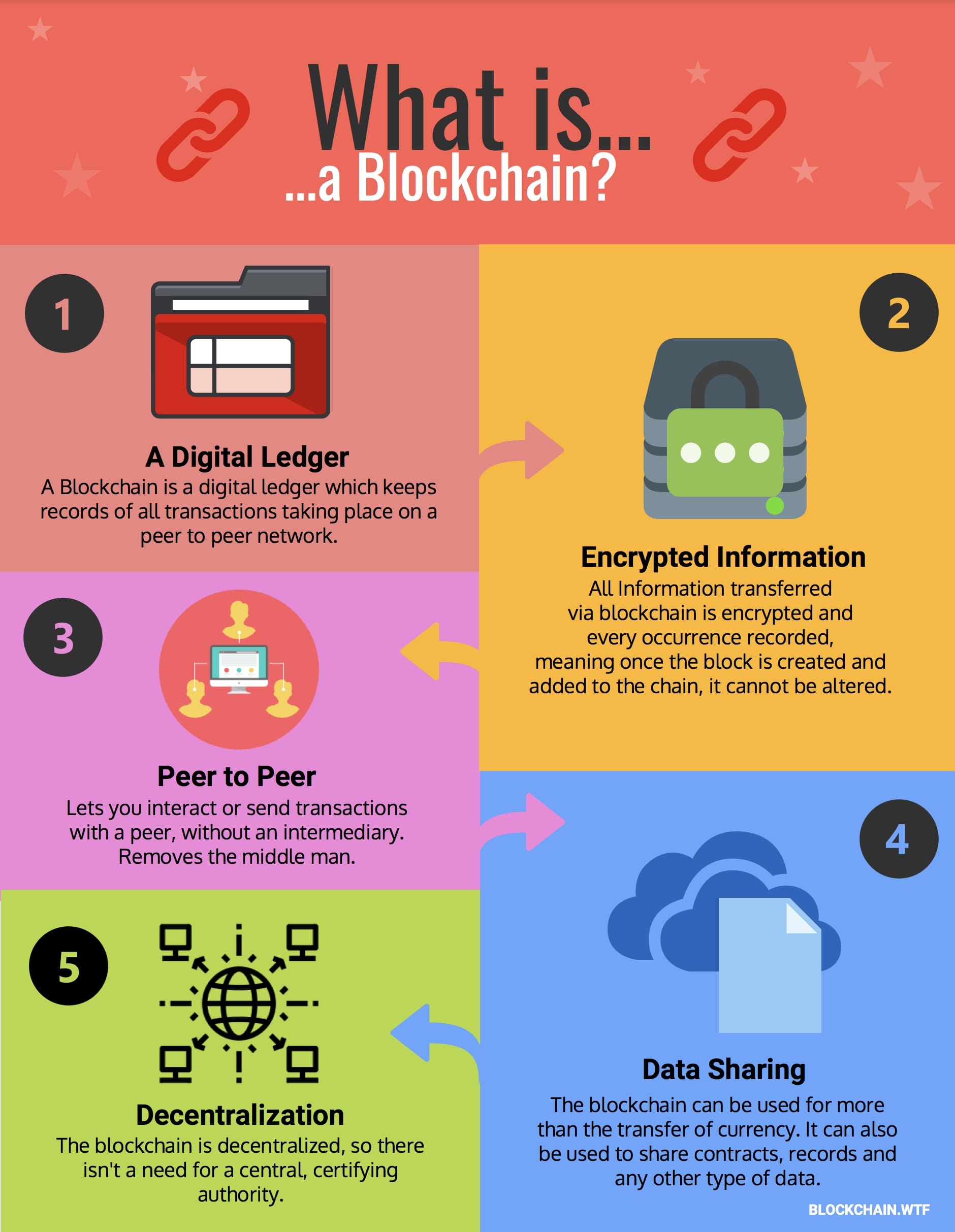

Why Should We Use Blockchain? A Simplified Explanation

Is Bitcoin Liquid? This depends on the transaction volume. On the stock exchange, the liquidity of a share depends on factors such as the value of the company, the free float, supply, and demand, etc. In the case of Bitcoin, float and demand seem to be the factors that determine the price. The high volatility of the Bitcoin price is due to less free float and more demand. The value of the virtual business depends on the experience of its members with Bitcoin transactions. We can get helpful comments from members.

What could be a major problem with this transaction system? Members cannot sell Bitcoin if they don’t have one. This means that you have to purchase it first by buying something valuable that you own, or by taking advantage of Bitcoin. Many of these precious things go to someone who is the original seller of Bitcoin. Of course, part of the profit will surely go to other members who are not the original Bitcoins maker. Some members also want to lose their valuables. With the increasing demand for Bitcoin, the original seller can produce more Bitcoins than the central banks. When the price of bitcoin rises in its market, home producers can slowly release their bitcoins into the system and make huge profits.

Bitcoin is an unregulated private virtual financial instrument.

Bitcoin is a virtual financial instrument. If Bitcoin holder is a private court to lose their Bitcoin contract issue, they don’t have to worry about the inviolable one. It is an individual virtual financial instrument for an exclusive group of people. People with bitcoins can buy large amounts of goods and buy goods that can destabilize the regular market. It will be a decision for the above. As in the 2007-2008 financial crises, the contract of the supervisory authorities can decide a new financial crisis. As always, we cannot judge the tip of the iceberg. We cannot foresee the damage that will die.

Only in the last phase do we see everything when we can do nothing but an emergency exit to overcome the crisis. We have closed through this since we received to experience things that we controlled. We have heard some and have failed in many, but not without sacrifice and loss. Should we wait to see everything? Read more about how it works, and here we explain further about how to use this currency and how everything works with the wallet and where to best get your own wallet.